Picture this: You’re three trades into your prop firm challenge, down 2%, and that little voice in your head whispers, “Just double up on the next trade. You’ll recover everything and more.” Sound familiar? If you’ve ever been tempted to use the Martingale strategy during a funded challenge, you’re not alone. But before you go down that rabbit hole, let’s have an honest conversation about why this approach might be the fastest way to turn your trading dreams into a nightmare.

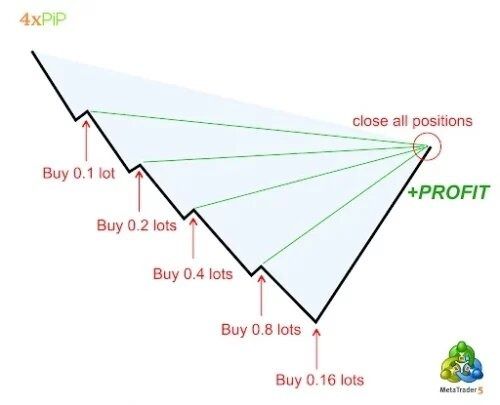

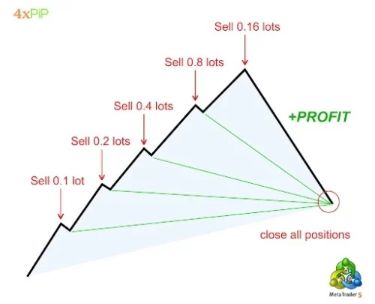

What Exactly Is the Martingale Strategy?

The Martingale strategy originated in 18th-century France, not in trading, but in gambling. The concept is deceptively simple: after every loss, you double your bet. The idea is that when you eventually win, you’ll recover all previous losses plus make a profit equal to your original bet.

In trading terms, this means:

- Trade 1: Risk $100, lose

- Trade 2: Risk $200, lose

- Trade 3: Risk $400, lose

- Trade 4: Risk $800, win

- Result: Net profit of $100 (assuming 1:1 risk-reward)

On paper, it looks foolproof. In reality, it’s a mathematical time bomb waiting to explode.

The Brutal Mathematics Behind Martingale

Let’s crunch some numbers that’ll make your head spin. Assume you start with a $100,000 funded account and begin with a 1% risk per trade ($1,000). Here’s how quickly things can spiral:

The Martingale Progression:

- Trade 1: Risk $1,000 (1%) – Loss

- Trade 2: Risk $2,000 (2%) – Loss

- Trade 3: Risk $4,000 (4%) – Loss

- Trade 4: Risk $8,000 (8%) – Loss

- Trade 5: Risk $16,000 (16%) – Loss

By trade 5, you’re risking 16% of your account on a single trade. Most prop firms have a maximum daily loss limit of 5% and overall drawdown limits of 10%. You’d be violating these rules catastrophically.

But here’s the kicker: the probability of losing 5 trades in a row, even with a 60% win rate, is about 1%. That sounds small, but if you’re an active trader taking 100 trades per month, you’re likely to encounter this scenario roughly once every 8-10 months. When it happens, game over.

Why Prop Firms Exist (And Why Martingale Defeats Their Purpose)

Prop firms aren’t charities. They’re businesses looking for consistent, profitable traders who can manage risk effectively. They provide capital because they believe skilled traders can generate steady returns while preserving capital.

The prop firm business model depends on:

- Consistent profitability – steady income streams

- Risk management – protecting their capital

- Scalability – traders who can handle larger accounts

- Longevity – sustainable trading careers

Martingale violates every single principle. It’s inherently inconsistent, catastrophically risky, impossible to scale safely, and has a 100% failure rate over time.

The Psychological Trap of “It Works Until It Doesn’t”

Here’s where things get dangerous. Martingale can work for weeks, even months. You might string together several successful recovery sequences, building false confidence. This is what behavioral economists call “survivorship bias” – you only remember the times it worked, not the traders who got wiped out.

I’ve seen traders use modified Martingale strategies and pass their first challenge, maybe even their second. They start believing they’ve “cracked the code.” Then comes the inevitable losing streak that destroys everything. The psychological damage is often worse than the financial loss.

Real-World Scenarios: When Martingale Goes Wrong

Case Study 1: The Overconfident Forex Trader Sarah passed her first $100k challenge using a modified Martingale on EUR/USD. She was feeling invincible until the March 2020 COVID crash. Five consecutive losing trades in volatile market conditions wiped out her account in three days. Not only did she lose her funded account, but she also violated the firm’s risk management rules so severely that she was permanently banned.

Case Study 2: The “Smart” Martingale User Mike thought he was clever. He used Martingale only on “high-probability” setups with 80% win rates. For six months, it worked beautifully. Then came a trending market that invalidated his setup for two weeks straight. The math eventually caught up, and he lost everything on trade 7 of his sequence.

The Hidden Costs of Martingale Thinking

Beyond the obvious financial risks, Martingale strategies create several hidden problems:

Skill Degradation: When you rely on position sizing to fix losses, you stop improving your actual trading skills. You become dependent on a flawed system rather than developing genuine edge.

Emotional Damage: The stress of exponentially increasing position sizes creates anxiety, leading to poor decision-making. Many traders develop lasting psychological issues around risk and money management.

Opportunity Cost: While you’re focused on recovering losses through Martingale, you’re missing legitimate trading opportunities that could build your account steadily.

Reputation Damage: Prop firms talk. If you’re known as a Martingale user, you might find it difficult to get accepted by other firms in the future.

What Prop Firms Actually Want to See

Instead of looking for get-rich-quick schemes, focus on what prop firms actually value:

Consistent Risk Management: They want to see steady 1-2% risk per trade, regardless of previous results.

Emotional Discipline: The ability to take losses without revenge trading or dramatically altering your approach.

Systematic Approach: A clear, repeatable process for finding and executing trades.

Adaptability: The ability to adjust to different market conditions without abandoning your core principles.

Patience: Understanding that building wealth takes time and that there are no shortcuts.

Better Alternatives to Martingale

If you’re attracted to Martingale because you want to recover losses quickly, consider these healthier alternatives:

Position Sizing Based on Confidence: Vary your position size based on the quality of your setup, not your previous results. Risk 0.5% on marginal setups, 1% on good setups, and 1.5% on exceptional setups.

Diversification: Instead of putting all your eggs in one basket, spread your risk across multiple uncorrelated trades.

Improved Edge: Focus on developing a genuine trading edge through better analysis, timing, and execution rather than relying on position sizing gimmicks.

Systematic Recovery: If you hit a drawdown, reduce your position size temporarily while maintaining your process. Let your edge work over time rather than trying to force quick recovery.

The Compound Interest Alternative

Here’s a mind-blowing fact: a trader who makes just 1% per month consistently will turn $100,000 into $320,000 in 10 years. That’s without any exotic strategies, just steady, consistent performance.

Compare that to Martingale, which offers the illusion of quick recovery but guaranteed eventual destruction. The math is clear: consistency beats aggression every time.

Legal and Ethical Considerations

Many prop firms explicitly prohibit Martingale strategies in their terms of service. Using them could void your contract and result in forfeiture of profits. Even if not explicitly banned, using strategies designed to circumvent risk management rules could be considered a breach of the spirit of the agreement.

From an ethical standpoint, prop firms are trusting you with their capital based on your demonstrated ability to trade responsibly. Using Martingale betrays that trust and could impact the entire industry if enough traders abuse the system.

Read this also Prop Firm Payout Explained

Building a Sustainable Trading Career

Instead of looking for shortcuts, focus on building a genuine trading career:

Develop Your Edge: Spend time understanding market mechanics, price action, and risk management. These skills compound over time.

Master Your Psychology: Learn to handle wins and losses with equal emotional balance. This is what separates professionals from gamblers.

Think Long-Term: Success in trading is measured in years, not days. Build systems that can work consistently over time.

Embrace the Process: Fall in love with the journey of improvement rather than just the destination of profit.

The Martingale Mindset vs. The Professional Mindset

The Martingale mindset says: “I need to recover my losses quickly, and I’m willing to take bigger risks to do it.”

The professional mindset says: “Losses are part of the business. I’ll stick to my process and let my edge work over time.”

This fundamental difference in thinking separates successful prop traders from those who flame out quickly.

What to Do If You’re Already Using Martingale

If you’re currently using Martingale strategies, it’s not too late to change course:

- Stop immediately – Don’t wait for “one more sequence”

- Reassess your risk management – Return to consistent position sizing

- Address the underlying issues – Why did you feel compelled to use Martingale in the first place?

- Develop a proper trading plan – Create a systematic approach that doesn’t rely on position sizing tricks

- Get help if needed – Consider working with a trading coach or mentor

Can you use Martingale in a funded challenge? Technically, maybe. Should you? Absolutely not. It’s a mathematically flawed strategy that will eventually destroy your trading career.

The allure of quick recovery is understandable, but the path to sustainable trading success lies in developing genuine skills, not in position sizing gimmicks. Prop firms are looking for professional traders who can manage risk effectively over the long term, not gamblers looking for quick fixes.

Your trading career is a marathon, not a sprint. Build it on a foundation of sound risk management, consistent execution, and continuous improvement. The traders who succeed in prop firms aren’t the ones who took the biggest risks; they’re the ones who managed risk most effectively while maintaining consistent performance.

Remember: in trading, boring is beautiful. The most successful prop traders are often the ones with the most “boring” equity curves – steady, consistent growth without dramatic peaks and valleys. That’s what builds wealth, passes challenges, and creates sustainable trading careers.

Skip the Martingale. Your future self will thank you.