Proprietary trading firms (prop firms) have revolutionized retail trading by providing access to significant capital without requiring traders to risk their own money. However, the challenge phases are designed to filter out inconsistent traders and identify those who can generate consistent profits while managing risk effectively. Smart Money Concepts (SMC) offer a sophisticated approach to understanding market structure and institutional behavior, making them particularly valuable for prop firm success.

This comprehensive guide will teach you how to leverage smart money concepts to not only pass prop firm challenges but to do so with confidence and consistency.

Understanding Prop Firm Psychology

Before diving into smart money concepts, it’s crucial to understand what prop firms are actually looking for. They’re not seeking traders who can make quick profits through high-risk strategies. Instead, they want consistent, disciplined traders who can:

- Demonstrate consistent profitability over time

- Manage risk effectively without violating drawdown limits

- Show emotional discipline during both winning and losing streaks

- Adapt to different market conditions

Smart money concepts align perfectly with these requirements because they focus on reading institutional behavior rather than gambling on price movements.

Core Smart Money Concepts for Prop Trading

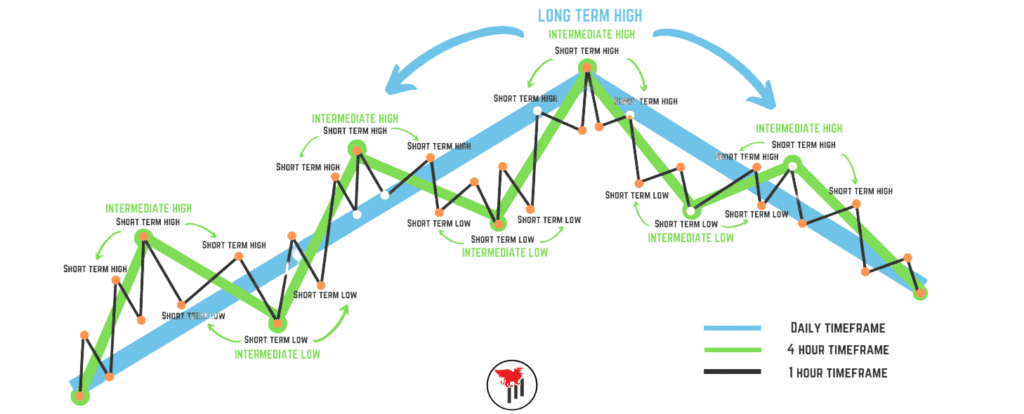

Market Structure Analysis

Market structure forms the foundation of smart money trading. Understanding how institutions move markets gives you an edge in predicting price movements with higher probability.

Key Elements:

- Higher Highs (HH) and Higher Lows (HL): Indicate bullish market structure

- Lower Highs (LH) and Lower Lows (LL): Indicate bearish market structure

- Break of Structure (BOS): Signals potential trend continuation

- Change of Character (ChoCh): Indicates potential trend reversal

For prop firm challenges, focus on trading only when market structure is clear. Avoid trades during consolidation periods where structure is ambiguous.

Order Blocks and Institutional Levels

Order blocks represent areas where large institutions have placed significant orders. These levels often act as strong support or resistance because institutions will defend their positions.

Identifying Order Blocks:

- Look for the last opposing candle before a strong move

- Focus on areas where price struggled to break through previously

- Pay attention to areas where price returns after breaking significant levels

Trading Order Blocks:

- Wait for price to return to these levels

- Look for confluence with other smart money concepts

- Use tight stop losses as these levels either hold or fail decisively

Liquidity Concepts

Understanding liquidity is crucial for prop firm success because it helps you predict where price is likely to move and why.

Types of Liquidity:

- Buy Side Liquidity: Stop losses above swing highs

- Sell Side Liquidity: Stop losses below swing lows

- Internal Liquidity: Stop losses within ranges

Liquidity Hunting Strategy:

- Identify areas of liquidity accumulation

- Wait for price to approach these areas

- Look for rejection signals

- Enter trades in the opposite direction

Fair Value Gaps (FVG)

Fair Value Gaps occur when there’s an imbalance between buying and selling pressure, creating inefficiencies that price often returns to fill.

Identifying FVGs:

- Look for three consecutive candles where the high of the first doesn’t touch the low of the third

- Focus on gaps created during high-momentum moves

- Prioritize gaps that align with overall market structure

Trading FVGs:

- Wait for price to return to the gap

- Enter when price shows signs of rejection from the gap

- Use the gap boundaries as reference points for entries and exits

Institutional Order Flow

Understanding how institutions enter and exit positions helps you align your trades with smart money rather than fighting against it.

Smart Money Entry Characteristics:

- Gradual accumulation rather than sudden spikes

- Volume precedes price movement

- Moves often happen during low-participation periods

- Price action shows controlled, methodical movement

Prop Firm-Specific Strategy Framework

Phase 1: Challenge Preparation

Market Selection:

- Focus on major forex pairs (EUR/USD, GBP/USD, USD/JPY)

- Trade during high-liquidity sessions (London and New York overlap)

- Avoid news events during challenge phases

Timeframe Strategy:

- Use daily charts for bias

- Execute on 1-hour and 15-minute charts

- Confirm entries on 5-minute charts

Risk Management Setup:

- Never risk more than 1% per trade

- Maintain a risk-reward ratio of at least 1:2

- Keep maximum daily drawdown under 2%

Phase 2: Entry Strategies

High-Probability Setup Identification:

- Structure Break and Retest: Wait for break of structure, then trade the retest of the broken level

- Order Block Rejection: Price returns to institutional order block and shows rejection

- Liquidity Grab and Reversal: Price takes liquidity then reverses from significant level

- FVG Fill and Continuation: Price fills gap then continues in the direction of the overall trend

Entry Confirmation Process:

- Market structure must be clear and aligned with trade direction

- Multiple confluences should be present

- Risk-reward ratio must be favorable

- No major news events in the next 4 hours

Phase 3: Trade Management

Stop Loss Placement:

- Below/above the order block being respected

- Beyond the recent swing high/low

- Never move stop loss against your position

Take Profit Strategy:

- First target: Next significant liquidity level

- Second target: Major structural level

- Trail stops using previous swing points

Position Sizing:

- Start with 0.5% risk per trade

- Increase to 1% only after proving consistency

- Reduce size during drawdown periods

Advanced Smart Money Techniques

Multi-Timeframe Analysis

Effective prop firm trading requires understanding how different timeframes interact:

Daily Chart: Overall market bias and major levels 4-Hour Chart: Intermediate structure and trend direction 1-Hour Chart: Entry timing and precise levels 15-Minute Chart: Final entry confirmation

Read this also Prop Firm Payout Explained

Session-Based Trading

Different trading sessions offer various opportunities:

Asian Session: Range-bound trading, liquidity building London Session: Trend initiation, major moves New York Session: Trend continuation, reversals Overlap Periods: Highest probability setups

Confluence Trading

The most successful prop firm traders wait for multiple confirmations:

- Market structure alignment

- Order block presence

- Liquidity levels

- Fair value gaps

- Fibonacci levels

- Previous day’s levels

Risk Management Mastery

The 1% Rule Implementation

Never risk more than 1% of your account per trade. This ensures that even a series of losses won’t threaten your challenge.

Calculation Example:

- $100,000 account

- 1% risk = $1,000 maximum loss per trade

- If stop loss is 50 pips, position size = $20 per pip

Drawdown Management

Prop firms typically allow 10% maximum drawdown and 5% daily drawdown. Smart money concepts help you stay within these limits by:

- Providing higher probability setups

- Offering better risk-reward ratios

- Reducing emotional trading decisions

- Improving timing of entries and exits

Position Sizing Psychology

Many traders fail prop firm challenges by overtrading. Smart money concepts help by:

- Providing clear entry signals

- Reducing the urge to chase trades

- Offering multiple opportunities daily

- Creating confidence in trade selection

Common Prop Firm Mistakes and How to Avoid Them

Mistake 1: Overtrading

Solution: Only trade when all smart money confluences align

Mistake 2: Revenge Trading

Solution: Use mechanical entry rules based on structure

Mistake 3: Ignoring Market Structure

Solution: Always check higher timeframe bias before entering

Mistake 4: Poor Risk Management

Solution: Stick to 1% risk rule regardless of confidence level

Mistake 5: Trading News Events

Solution: Avoid trading 2 hours before and after major news

Building Your Prop Firm Trading Plan

Daily Routine

Pre-Market Analysis (30 minutes):

- Review daily chart bias

- Identify key levels and order blocks

- Note upcoming news events

- Set daily risk limits

Trading Session (2-4 hours):

- Wait for setups to develop

- Execute only A+ setups

- Manage trades according to plan

- Document all trades

Post-Market Review (15 minutes):

- Review trades taken

- Analyze what worked and what didn’t

- Plan for next session

- Update trading journal

Weekly Review Process

- Analyze overall performance

- Identify patterns in wins and losses

- Adjust strategy if needed

- Set goals for upcoming week

Monthly Assessment

- Calculate profit factor

- Review risk management effectiveness

- Analyze emotional discipline

- Plan for continuous improvement

Psychological Aspects of Prop Trading

Developing Patience

Smart money concepts require patience. Institutions don’t rush, and neither should you. Wait for clear setups rather than forcing trades.

Managing Expectations

Prop firm challenges are designed to be passed consistently, not quickly. Focus on consistent small gains rather than home runs.

Handling Drawdowns

Drawdowns are normal and expected. Smart money concepts help minimize them, but they’ll still occur. Have a plan for reducing size during drawdown periods.

Staying Disciplined

The biggest advantage of smart money concepts is that they provide objective entry and exit criteria, removing emotion from trading decisions.

Technology and Tools

Charting Platform Setup

Essential Indicators:

- None required – pure price action

- Optional: Previous day high/low

- Optional: Session indicators

Chart Configuration:

- Clean charts with minimal indicators

- Clear marking of order blocks

- Highlighted liquidity levels

- Noted fair value gaps

Record Keeping

Maintain detailed records of:

- Trade setups and rationale

- Entry and exit points

- Risk-reward achieved

- Market conditions

- Emotional state during trade

Advanced Concepts for Experienced Traders

Institutional Footprint Analysis

Understanding how large players move the market provides additional edge:

- Volume at key levels

- Order flow imbalances

- Absorption patterns

- Momentum shifts

Seasonal and Cyclical Patterns

Certain times of year offer better opportunities:

- End of month/quarter effects

- Holiday period characteristics

- Central bank meeting cycles

- Economic calendar patterns

Intermarket Analysis

Understanding relationships between different markets:

- Currency correlations

- Bond market influence

- Commodity relationships

- Stock market impacts

Read this also BOS vs CHoCH : What is the Actual Difference?

Passing prop firm challenges using smart money concepts requires a combination of technical knowledge, risk management, and psychological discipline. The key is to think like an institution rather than a retail trader. This means being patient, selective, and methodical in your approach.

Remember that prop firms want consistent traders, not gamblers. Smart money concepts provide the framework for consistent profitability by helping you understand market mechanics rather than relying on luck or intuition.

Start with smaller position sizes, focus on high-probability setups, and gradually increase your risk as you prove your consistency. The goal isn’t to pass the challenge quickly, but to develop the skills necessary for long-term success in prop trading.

By following the principles outlined in this guide, you’ll not only increase your chances of passing prop firm challenges but also develop the foundation for a successful trading career. The smart money approach isn’t just about passing challenges—it’s about building sustainable trading skills that will serve you throughout your career.

Success in prop trading comes from understanding that you’re not competing against the market, but rather aligning yourself with the smart money that moves it. Master these concepts, remain disciplined in your approach, and prop firm success will follow naturally.