Introduction: The Foundation of Market Structure Understanding

In the world of Inner Circle Trader (ICT) methodology, few concepts are as fundamental yet frequently misunderstood as the distinction between Break of Structure (BOS) and Change of Character (CHoCH). These two terminologies form the cornerstone of market structure analysis, yet their subtle differences often confuse even experienced traders. Understanding these concepts is crucial for proper market structure identification, trade entry timing, and risk management within the ICT framework.

The confusion surrounding BOS and CHoCH stems from their interconnected nature and the fact that both involve breaks in market structure. However, their implications for market direction, trading psychology, and strategy implementation are distinctly different. This article will provide a comprehensive examination of both concepts, their practical applications, and how to distinguish between them in real-time trading scenarios.

Understanding Market Structure: The Prerequisites

Before diving into the specific differences between BOS and CHoCH, it is essential to establish a solid foundation in market structure basics as defined by ICT methodology. Market structure in ICT terms refers to the arrangement of swing highs and swing lows that create recognizable patterns in price movement.

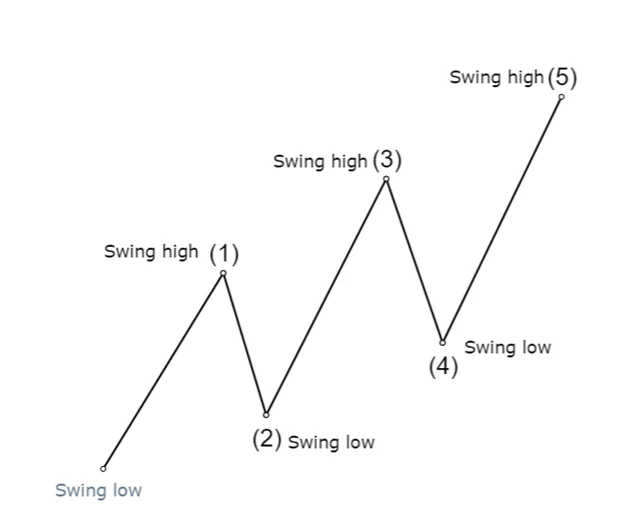

The Building Blocks: Swing Highs and Swing Lows

In ICT methodology, swing highs and swing lows are not arbitrary points but specific formations that meet precise criteria. A swing high must have at least one lower high on both sides, while a swing low must have at least one higher low on both sides. These formations create the skeletal framework upon which market structure analysis is built.

The significance of these swing points extends beyond mere technical analysis. They represent psychological levels where market participants have previously made decisions, creating areas of potential support and resistance. Understanding this psychological component is crucial for comprehending why BOS and CHoCH events carry such weight in market analysis.

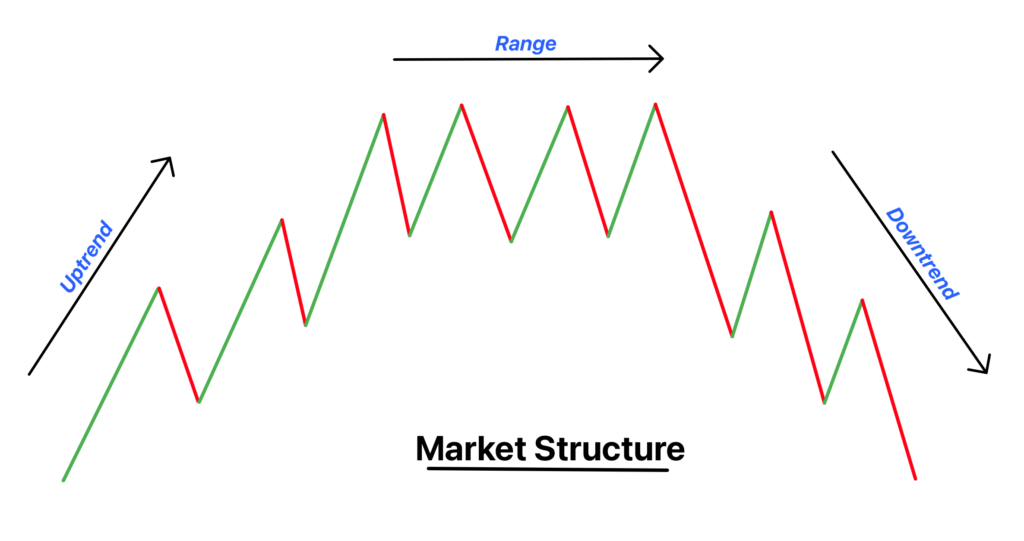

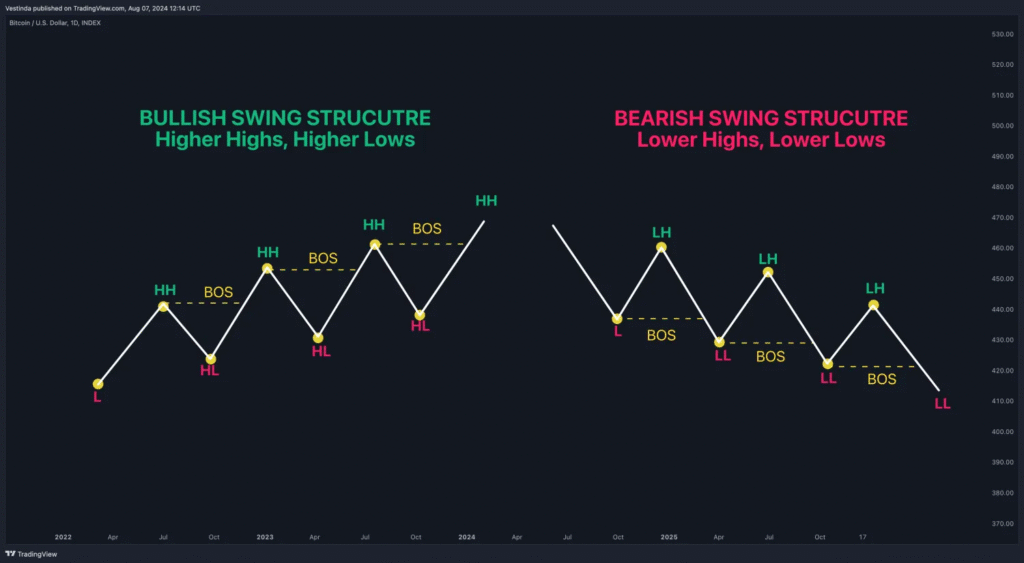

Market Structure States: Bullish, Bearish, and Ranging

ICT methodology recognizes three primary market structure states: bullish (higher highs and higher lows), bearish (lower highs and lower lows), and ranging (sideways movement with no clear directional bias). The identification of these states provides context for understanding when BOS and CHoCH events occur and their potential implications.

In a bullish market structure, we expect to see higher highs and higher lows forming in sequence. In a bearish market structure, we expect lower highs and lower lows. When this sequence is broken, we encounter either a BOS or CHoCH event, depending on the specific circumstances and the nature of the break.

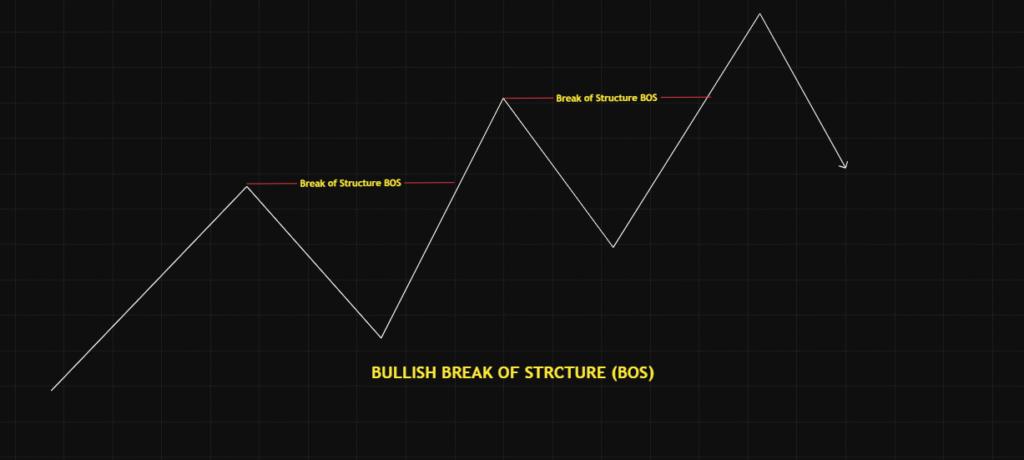

Break of Structure (BOS): Definition and Characteristics

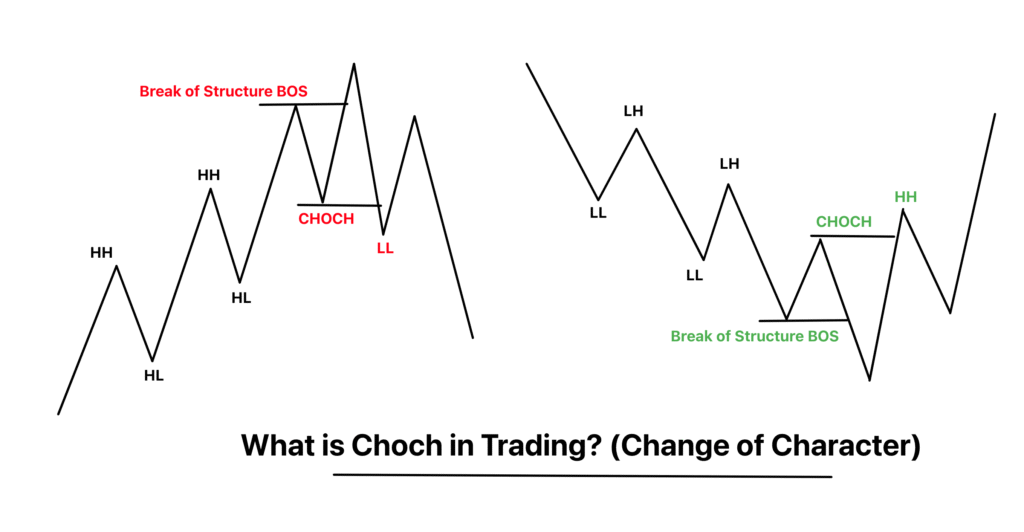

Break of Structure represents a continuation pattern within the existing market structure. When price breaks a previous swing high in a bullish market structure or a previous swing low in a bearish market structure, this action confirms the continuation of the current trend. BOS events serve as validation points for the existing directional bias.

The Mechanics of BOS Formation

A BOS occurs when price decisively breaks through a previous swing point in the direction of the current trend. In a bullish market structure, this means price breaking above a previous swing high. In a bearish market structure, this means price breaking below a previous swing low. The key element is that this break maintains the existing sequence of higher highs and higher lows (bullish) or lower highs and lower lows (bearish).

The formation of a BOS typically follows a period of consolidation or pullback within the existing trend. This consolidation phase allows for the accumulation of orders and the preparation for the next directional move. When sufficient momentum builds, price breaks through the previous swing point, creating the BOS event.

Psychological Implications of BOS

From a market psychology perspective, BOS events represent moments of trend confirmation. Market participants who were uncertain about the trend’s continuation receive validation through the break of the previous swing point. This confirmation often leads to increased participation in the direction of the trend, creating momentum that can sustain the directional move.

The psychological impact of BOS extends to both retail and institutional participants. Retail traders often use BOS events as entry signals, believing that the break confirms trend continuation. Institutional participants may use these moments to increase their positions or to trigger algorithmic trading systems designed to capitalize on momentum.

Identification Criteria for BOS

Proper identification of BOS events requires adherence to specific criteria. The break must be clean and decisive, not merely a brief spike that quickly reverses. Many traders use the concept of a “displacement” to confirm BOS events, where price moves rapidly away from the broken level with strong momentum.

Time frame considerations are crucial for BOS identification. A BOS on a higher time frame carries more significance than one on a lower time frame. ICT methodology emphasizes the importance of multi-time frame analysis, where BOS events are confirmed across multiple time frames to increase their reliability.

Change of Character (CHoCH): Definition and Characteristics

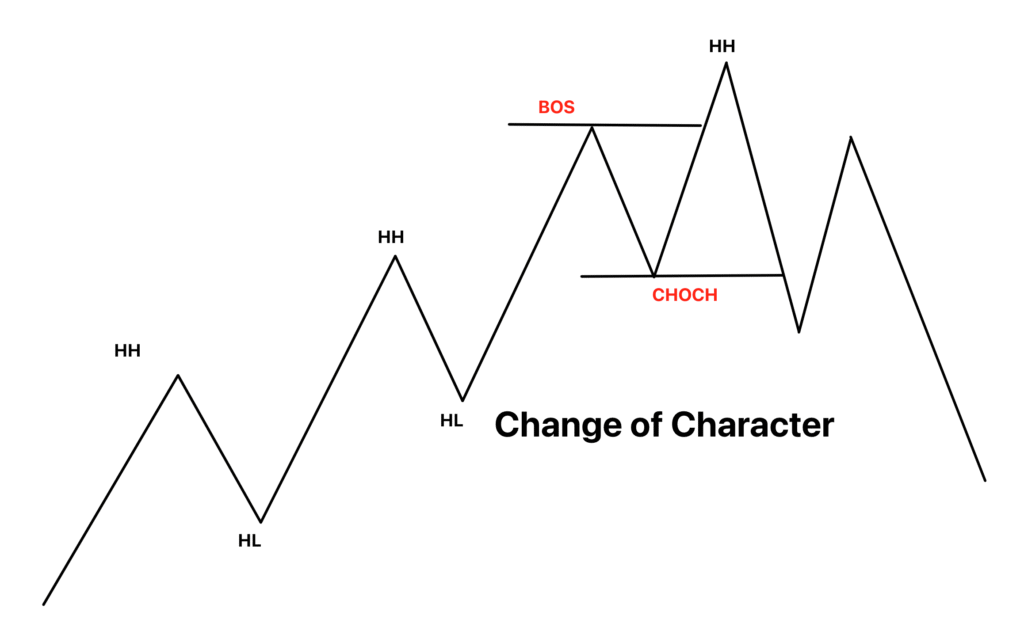

Change of Character represents a potential reversal pattern within the existing market structure. When price breaks a previous swing low in a bullish market structure or a previous swing high in a bearish market structure, this action suggests a potential change in the directional bias. CHoCH events serve as early warning signals for potential trend reversals.

The Mechanics of CHoCH Formation

A CHoCH occurs when price decisively breaks through a previous swing point against the direction of the current trend. In a bullish market structure, this means price breaking below a previous swing low. In a bearish market structure, this means price breaking above a previous swing high. The key element is that this break disrupts the existing sequence of swing points.

The formation of a CHoCH typically follows a period of weakness in the existing trend. This weakness may manifest as diminishing momentum, failure to create new swing points in the trend direction, or increased volatility. When this weakness culminates in a break against the trend, it creates the CHoCH event.

Psychological Implications of CHoCH

From a market psychology perspective, CHoCH events represent moments of potential trend exhaustion. Market participants who were comfortable with the existing trend face the possibility that the directional bias may be changing. This uncertainty often leads to profit-taking by trend followers and increased attention from counter-trend participants.

The psychological impact of CHoCH can be more dramatic than BOS events because they challenge the existing market narrative. Participants who were positioned in the direction of the previous trend may experience anxiety or urgency to adjust their positions. This emotional response can create volatility and accelerate the potential reversal process.

Identification Criteria for CHoCH

Proper identification of CHoCH events requires careful attention to the context within which they occur. The break must represent a genuine disruption to the existing market structure, not merely a temporary retracement. Many traders look for additional confirmation signals, such as shifts in momentum indicators or changes in volume patterns.

The significance of CHoCH events is often enhanced by their location relative to key psychological levels or institutional reference points. A CHoCH event that occurs near a major support or resistance level carries more weight than one that occurs in the middle of a range.

BOS vs CHoCH

The fundamental difference between BOS and CHoCH lies in their relationship to the existing market structure and their implications for future price movement. Understanding these differences is crucial for proper market analysis and trading decision-making.

Directional Relationship to Trend

The most obvious difference between BOS and CHoCH is their directional relationship to the existing trend. BOS events move with the trend, confirming its continuation. CHoCH events move against the trend, suggesting potential reversal. This directional relationship determines how traders should interpret and respond to each type of event.

In practical terms, this means that BOS events in a bullish market structure involve upward breaks, while CHoCH events involve downward breaks. The inverse is true for bearish market structures. This directional distinction provides immediate context for understanding the market’s potential next move.

Market Structure Implications

BOS events maintain the existing market structure sequence, while CHoCH events disrupt it. This distinction has profound implications for market structure analysis. A BOS event suggests that the current sequence of swing points will continue, while a CHoCH event suggests that this sequence may be ending.

The market structure implications extend to multiple time frames. A CHoCH event on a higher time frame may signal a major trend reversal, while a BOS event on the same time frame confirms trend continuation. Understanding these implications helps traders position themselves appropriately for different market scenarios.

Trading Psychology and Participant Behavior

The psychological responses to BOS and CHoCH events differ significantly. BOS events typically generate confidence among trend followers and may attract new participants to join the existing trend. CHoCH events typically generate uncertainty among trend followers and may attract counter-trend participants.

This difference in participant behavior creates distinct trading opportunities. BOS events often lead to momentum-based trading opportunities, while CHoCH events may create mean reversion opportunities. Understanding these behavioral patterns helps traders select appropriate strategies for different market conditions.

Risk Management Considerations

The risk management implications of BOS and CHoCH events are markedly different. BOS events typically offer more straightforward risk management, as the broken level often serves as a natural stop-loss reference point. CHoCH events require more nuanced risk management, as the potential for false signals is higher.

Risk-to-reward ratios also differ between BOS and CHoCH scenarios. BOS events may offer extended trending moves with favorable risk-to-reward ratios. CHoCH events may offer quick reversals with limited profit potential but higher probability of false signals.

Identifying BOS and CHoCH in Real-Time

The theoretical understanding of BOS and CHoCH must be complemented by practical skills for real-time identification. This section provides a framework for recognizing these events as they unfold in live market conditions.

Time Frame Analysis

Multi-time frame analysis is essential for proper BOS and CHoCH identification. Events that appear significant on lower time frames may be insignificant in the context of higher time frame market structure. Conversely, events that appear minor on higher time frames may provide excellent trading opportunities on lower time frames.

The recommended approach involves starting with higher time frames to establish the overall market structure context, then moving to lower time frames to identify specific BOS and CHoCH events. This top-down approach ensures that trading decisions align with the broader market structure.

Confirmation Techniques

Reliable identification of BOS and CHoCH events requires confirmation through multiple technical factors. These may include momentum indicators, volume analysis, or price action patterns. The goal is to distinguish between genuine structural events and false signals that may trap unwary traders.

One effective confirmation technique involves waiting for a displacement move following the initial break. This displacement should demonstrate clear momentum in the direction of the break, providing additional evidence that the event is genuine. The absence of such displacement may indicate a false signal.

Common Identification Pitfalls

Several common pitfalls can lead to misidentification of BOS and CHoCH events. These include focusing on single time frames, ignoring broader market context, and failing to wait for proper confirmation. Understanding these pitfalls helps traders avoid costly mistakes.

Another common pitfall involves confusing temporary spikes with genuine breaks. Market makers and institutional participants often create temporary spikes designed to trigger stop-losses or test market liquidity. These spikes may appear to create BOS or CHoCH events but quickly reverse, trapping traders who acted too quickly.

Advanced Concepts: Liquidity and Market Maker Behavior

Understanding BOS and CHoCH events requires comprehension of underlying liquidity dynamics and market maker behavior. These advanced concepts provide deeper insight into why these events occur and how they can be traded effectively.

Liquidity Concepts in BOS and CHoCH

Liquidity plays a crucial role in the formation of both BOS and CHoCH events. Swing highs and lows represent areas where liquidity is concentrated, as these levels attract stop-losses and pending orders. The breaking of these levels triggers this liquidity, creating the momentum necessary for BOS and CHoCH events.

Market makers and institutional participants are acutely aware of these liquidity pools and may specifically target them to facilitate large position changes. Understanding this dynamic helps traders anticipate when BOS and CHoCH events are likely to occur and how to position themselves accordingly.

Market Maker Models and Structural Breaks

ICT methodology includes sophisticated models for understanding market maker behavior and its relationship to structural breaks. These models suggest that market makers use BOS and CHoCH events as part of their accumulation and distribution processes.

The implication is that not all BOS and CHoCH events are created equal. Some represent genuine shifts in market sentiment, while others represent temporary liquidity grabs by market makers. Distinguishing between these scenarios requires understanding of market maker models and their typical behavior patterns.

Institutional Order Flow

Institutional order flow analysis provides additional context for understanding BOS and CHoCH events. Large institutional orders often create the momentum necessary for these events, and understanding institutional behavior patterns can help predict when they are likely to occur.

The timing of institutional activity often correlates with specific market sessions and economic events. This timing consideration adds another layer of analysis to BOS and CHoCH identification, helping traders position themselves for the most significant events.

Trading Strategies: Implementing BOS and CHoCH Analysis

The practical application of BOS and CHoCH analysis requires specific trading strategies designed to capitalize on these events while managing associated risks. This section outlines proven approaches for trading both types of structural breaks.

BOS Trading Strategies

BOS events lend themselves to momentum-based trading strategies. The confirmation of trend continuation provided by BOS events creates opportunities for traders to join the existing trend with favorable risk-to-reward ratios. These strategies typically involve entering positions following the BOS event and riding the momentum until the next significant structural level.

Entry techniques for BOS trading may include immediate entries following the break, pullback entries to the broken level, or entries based on lower time frame confirmations. Each approach has different risk-reward characteristics and suits different trading styles.

CHoCH Trading Strategies

CHoCH events require more cautious trading approaches due to their potential for false signals. Strategies for trading CHoCH events often involve waiting for additional confirmation before entering positions. This confirmation may come from higher time frame analysis, momentum indicators, or specific price action patterns.

The potential for trend reversal following CHoCH events creates opportunities for counter-trend trading. However, these opportunities come with higher risk and require careful risk management. Many traders prefer to wait for multiple confirmations before committing to counter-trend positions based on CHoCH events.

Risk Management Protocols

Effective risk management is crucial for both BOS and CHoCH trading strategies. The different characteristics of these events require different risk management approaches. BOS events may allow for wider stop-losses due to their momentum characteristics, while CHoCH events may require tighter stop-losses due to their higher probability of false signals.

Position sizing considerations also differ between BOS and CHoCH scenarios. The higher reliability of BOS events may justify larger position sizes, while the uncertainty associated with CHoCH events may warrant smaller positions until additional confirmation is received.

Common Mistakes and How to Avoid Them

Understanding common mistakes in BOS and CHoCH analysis helps traders avoid costly errors and improve their overall trading performance. This section identifies frequent pitfalls and provides strategies for avoiding them.

Over-Trading Based on Lower Time Frame Events

One of the most common mistakes involves over-trading based on BOS and CHoCH events that appear significant on lower time frames but are insignificant in the broader market structure context. This mistake often leads to excessive trading costs and poor risk-adjusted returns.

The solution involves maintaining discipline regarding time frame hierarchy. Events on higher time frames should always take precedence over events on lower time frames. This discipline helps traders focus on the most significant opportunities while avoiding market noise.

Ignoring Market Context

Another frequent mistake involves identifying BOS and CHoCH events in isolation without considering broader market context. This approach often leads to trades that are technically correct but fundamentally flawed due to conflicting market forces.

Comprehensive market context analysis should include economic events, market sentiment, and broader technical analysis. This holistic approach helps traders understand when BOS and CHoCH events are likely to succeed and when they may fail due to external factors.

Premature Entry and Exit Decisions

The excitement of identifying BOS and CHoCH events often leads to premature trading decisions. Traders may enter positions too early, before proper confirmation, or exit positions too quickly, missing significant moves.

Developing patience and discipline is crucial for successful BOS and CHoCH trading. This involves waiting for proper confirmation before entering positions and allowing sufficient time for trades to develop according to their potential.

Mastering the Distinction

The distinction between BOS and CHoCH represents one of the most important concepts in ICT methodology. Understanding this distinction enables traders to interpret market structure correctly, make informed trading decisions, and manage risk effectively. The key lies in recognizing that BOS events confirm existing trends while CHoCH events suggest potential reversals.

Successful application of these concepts requires combining theoretical understanding with practical experience. Traders must develop the ability to identify these events in real-time while maintaining proper risk management and avoiding common pitfalls. The investment in mastering these concepts pays dividends through improved trading performance and better market understanding.

The evolution of market structure analysis continues as markets become more complex and sophisticated. However, the fundamental principles underlying BOS and CHoCH analysis remain relevant and valuable for traders seeking to understand market behavior and capitalize on structural opportunities. Mastering these concepts provides a solid foundation for advanced ICT trading strategies and long-term trading success.